|

||||||||||||

|

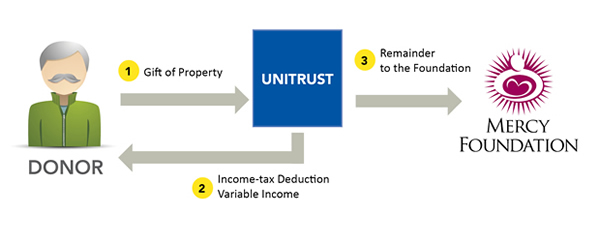

Charitable Remainder Unitrusts

How it works

![]() You transfer cash, securities or other appreciated property into a trust.

You transfer cash, securities or other appreciated property into a trust.

![]() The trust pays a percentage of the assets market value, re-valued annually, to you or to beneficiaries you name.

The trust pays a percentage of the assets market value, re-valued annually, to you or to beneficiaries you name.

![]() When the trust ends, the principal passes to Mercy Foundation.

When the trust ends, the principal passes to Mercy Foundation.

Benefits

- You receive an immediate income-tax deduction for a portion of your contribution to the trust.

- You pay no capital-gains tax on appreciated assets you donate.

- You or your designated beneficiaries receive payments for life or a term of years.

- You can make additional gifts to the trust as your circumstances allow and qualify for additional tax deductions.

- You can make a significant gift that benefits you now and Mercy Foundation later.

Consider a charitable remainder unitrust if you:

- Want to make a major gift to Mercy Foundation while retaining or increasing your cash flow from the assets you contribute

- Have appreciated assets – securities, a business, or investment real estate – and want to avoid the capital-gains cost of a sale

- Want the income from your gift to be able to grow over time

- Want maximum flexibility in the operation of your gift:

- Income paid to your beneficiary for a term of years instead of their lifetime

- Income to go to more than one beneficiary

- The option of choosing your gift plan trustees

- To donate an appreciating, but temporarily illiquid, asset to Mercy Foundation

Related Links

More about charitable remainder unitrusts

Gift example

Planning tips

For assistance with this gift plan, please complete the request information form or contact Kevin Duggan at (916) 851-2703 or e-mail to Kevin.Duggan@DignityHealth.org.